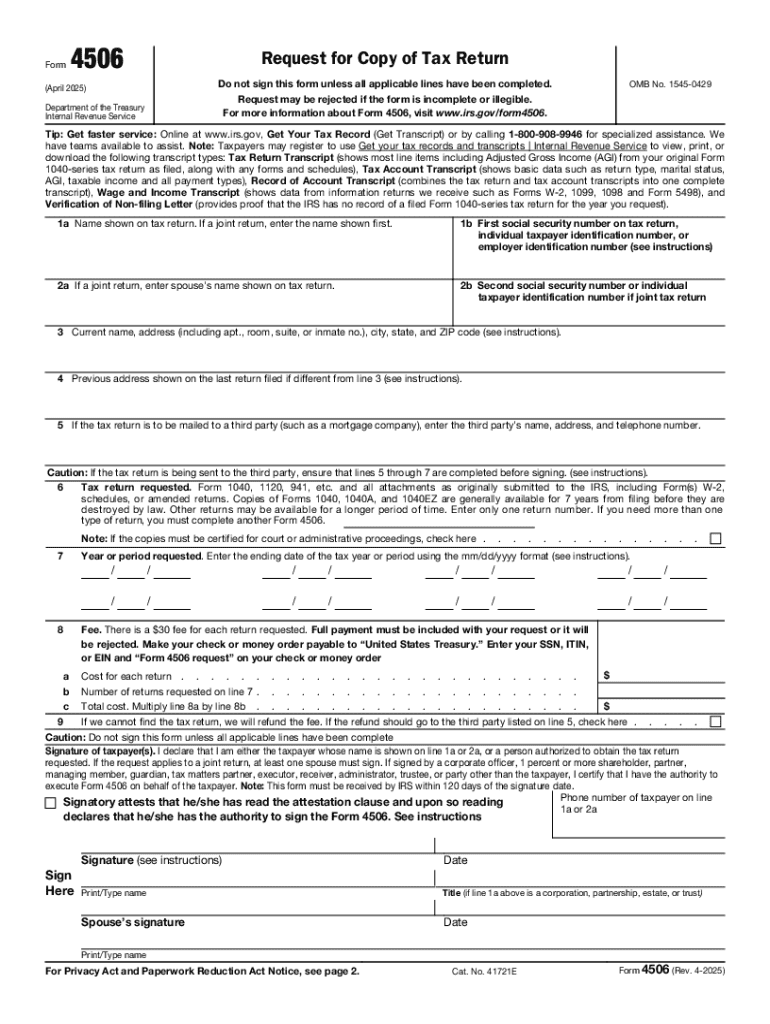

IRS 4506 2025-2026 free printable template

Instructions and Help about IRS 4506

How to edit IRS 4506

How to fill out IRS 4506

Latest updates to IRS 4506

All You Need to Know About IRS 4506

What is IRS 4506?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4506

What should I do if I discover an error after submitting IRS 4506?

If you discover an error after submitting the IRS 4506, you must submit a corrected form to the IRS if the mistake affects the information provided. It's important to clearly indicate which fields have been corrected to avoid confusion during processing.

How can I track the status of my IRS 4506 submission?

To track the status of your IRS 4506 submission, you can contact the IRS directly. Generally, it may take several weeks to process, and you should keep your confirmation for your records. Checking your status can help ensure that all information has been processed accurately.

What are common mistakes to avoid when submitting IRS 4506?

Common mistakes when submitting the IRS 4506 include omitting required information, failing to sign the form, or using incorrect tax years. Ensuring that all sections are complete and accurate can help prevent delays or rejections.

Can I e-file my IRS 4506, and what are the requirements?

Yes, you can e-file your IRS 4506 through authorized e-filing providers. Make sure to use compatible software and adhere to any specific technical requirements to avoid processing issues.

What should I prepare if I receive a notice from the IRS regarding my IRS 4506?

If you receive a notice from the IRS regarding your IRS 4506, carefully review the notice for specific instructions. Prepare to gather any requested documentation and contact a tax professional if you need clarification on how to respond.

See what our users say