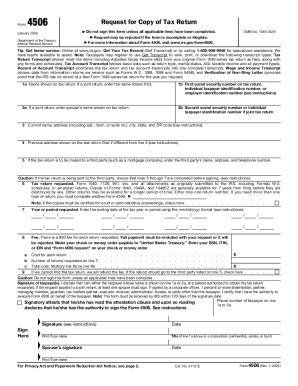

What is IRS form 4506?

Taxpayers use form 4506 to request a copy of their previously filed tax return from the Internal Revenue Service, such as 1040, 1065, 1120, 941, W-2 reports. The IRS keeps most of the tax return documents for seven years before destroying them. Therefore, it's possible to request copies for the current or past six years. Taxpayers can request copies of their tax reports for different reasons. For example, audit or court purposes, when they need to correct and resend the prior-year tax report, claim a refund, apply for federal student aid, etc. The copies of tax returns are used to determine the financial stability of taxpayers before giving them a mortgage.

The 4506 form requires a $43 fee to pay for each copy requested.

Who should file the IRS 4506 form?

Individuals, companies, partnerships, and other taxpayers can use form 4506 to request copies of their tax returns.

What information do you need when you file form 4506?

The IRS form 4506 is simple to complete and doesn't require much information from a taxpayer. When preparing it, you should indicate the following:

- Your name, as shown on the tax return document – for joint returns, you should also provide your spouse's details

- Your SSN, ITIN, or EIN

- Taxpayer's address and the address from the previous tax return, if different from the current one

- Name, address, and phone number of the third party to whom you need to provide the copy (if applicable)

- The number of the tax return document and the period requested

- The number of returns requested and the total fees paid (each return costs $43) – If the IRS can't find a specific document, they will provide a refund

The applicant (and their spouse, if applicable) must date and sign form 4506 before filing it.

How do you fill out IRS form 4506?

With pdfFiller’s online editor, filling out form 4506 is easy and fast:

- Click Get Form to open your Request of Copy of Tax Return in pdfFiller editor.

- Type in your details and the information on the tax forms requested.

- If you need a certified copy for court or administrative purposes, put a checkmark in the corresponding field.

- Date your document and add your legally-binding electronic signature.

- Click Done, then download, print your form 4506, or use the Send via USPS option to send it directly from the editor.

Is form 4506 accompanied by other forms?

There is no need to attach other documents to this request.

When is form 4506 due?

The taxpayer can send form 4506 to request tax return copies whenever they need them or when a third party requires it. There is no specific deadline or due date for submission. Remember that it can take up to 75 days to process the request.

Where do I send IRS form 4506?

After completing and signing the 4506 form, you must send it to the appropriate IRS office with a payment check. The filing address depends on where you lived and submitted the tax return earlier. On the second page of your form 4506, several IRS offices' addresses are grouped by state. Please note that for copies other than 1040, there's a different list of addresses to file your requests.

If you complete your 4506 form online in pdfFiller, you can benefit from its advanced file sharing features and send your document via USPS service right from the editor – no need to print it or go to the post office.